Portfolio performance measurement, a modern approach

One of the challenges facing buy-side Investors, whether institutional or private, is to get accurate investment and portfolio returns out of their financial software. Nowadays, the value of your data is key, but most of it is unstructured. Organising that data can be time-consuming and have a high margin for error when done manually.

The challenge for wealth management software then is to:

- Calculate accurate Investment returns across all types of assets

- Perform performance attribution analysis

The background:

Private banks often have to rely on performance figures given by their custodians, or, in some cases, they calculate their own cumulative performance. Cumulative performance lacks the accuracy given by the TWR (Time Weighted Returns) performance figures.

Time Weighted Returns are complex to compute, it requires a structured set of data coupled with the design of a computation algorithm (multiply the returns for each holding period).

As a result, Private banks and Family Offices (buy-side in general) find themselves having to rely on performance figures given by their custodians. In such circumstances the limitations are:

- Difficulty to carry out due diligence on performance figures given by the banks

- Lack of aggregated performance figures across multiple custodians or across several accounts

Portfolio performance: what is the modern approach compared to the traditional approach?

The traditional approach to monitoring portfolio performance uses a standard database or flat files, where data is set out in a table across 2 axes, typically using excel. This can be cumbersome, time-consuming and still need manual intervention to produce the figures you need.

However, in this competitive market, investors need the ability to access real-time data across portfolios. This has led to the modern approach of producing portfolio performance figures, using 'Business Intelligence' (BI), which calculates and stores figures in a 'Cube'.

Combining BI with multi-dimensional cubes, provide a lot more insight by allowing Investors to use their Wealth management software to connect to their data in a much more dynamic way.

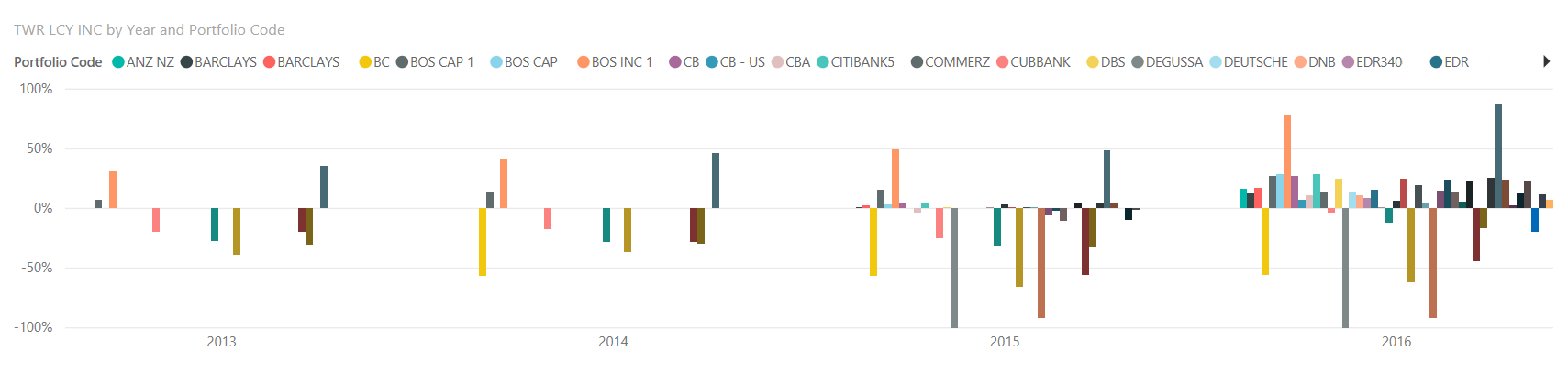

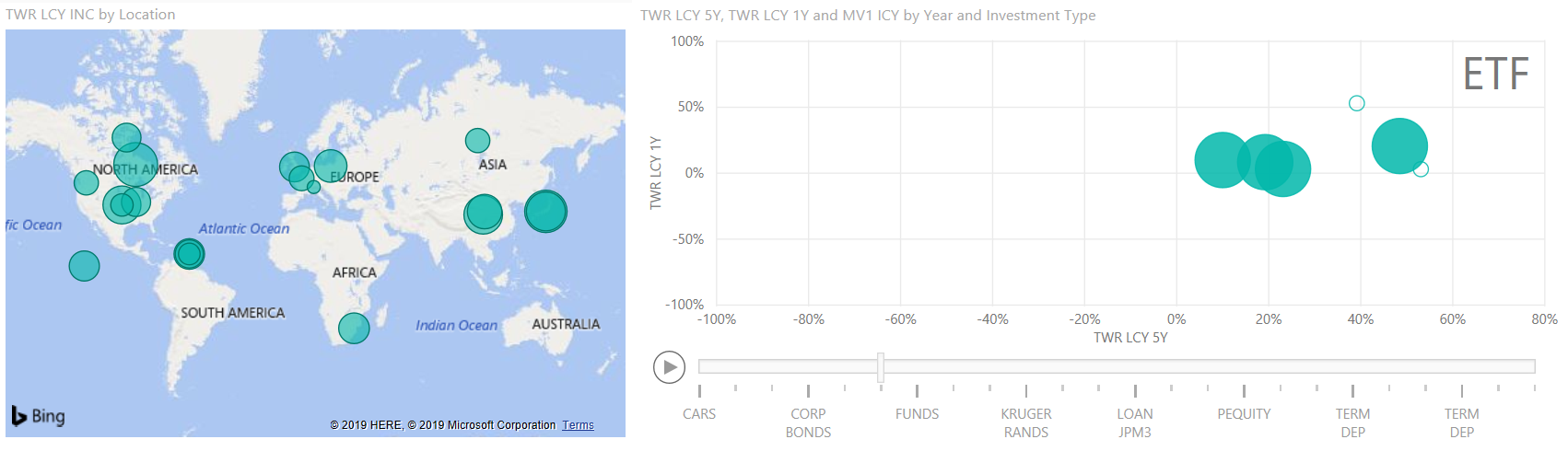

BI shows the information in any way needed, with instant real-time access to the data. The cube then allows them to interpret the results in a 3-dimensional view e.g. return across portfolio, Investment types and time. The performance data can be sliced and diced by any dimensions needed, for example; region, currency, asset class, but also market cap, Dividend Yield, etc.

Multi-dimensional BI models offer the following benefits:

- Multidimensional performance attributions

- Trustworthy data and calculations

- Speed-of-thought analysis

- Flexible, self-service reporting

Leverage your wealth management software for performance attribution

Business Intelligence (BI) technology produces performance figures for any attribute captured inside your Family office software or your fund management software.

If we can compute performance figures such as TWR inside a multi-dimensional cube then we can easily do performance attribution.

Once all the performance numbers are in the cube, users will find it easy to select any particular attribute(s) and show performance for this subset of data. There is no limitation as to what attribute or combination of attributes to use, as long as they are included in the transactional data.

In Conclusion

Since accurate performance reports and dashboards can be produced and easily published to various stakeholders, BI combined with Cube technology is the modern way to measure portfolio performance.

The Speed, flexibility and richness of data from Business Intelligence (BI) will no doubt offer any wealth management institution the competitive advantage they need to better service their institutional or private clients with a platform to serve.

If you want to talk to us about personalised Family Office software, using BI, please email us on elysys@elysys.com or call us +377 97 97 71 55.