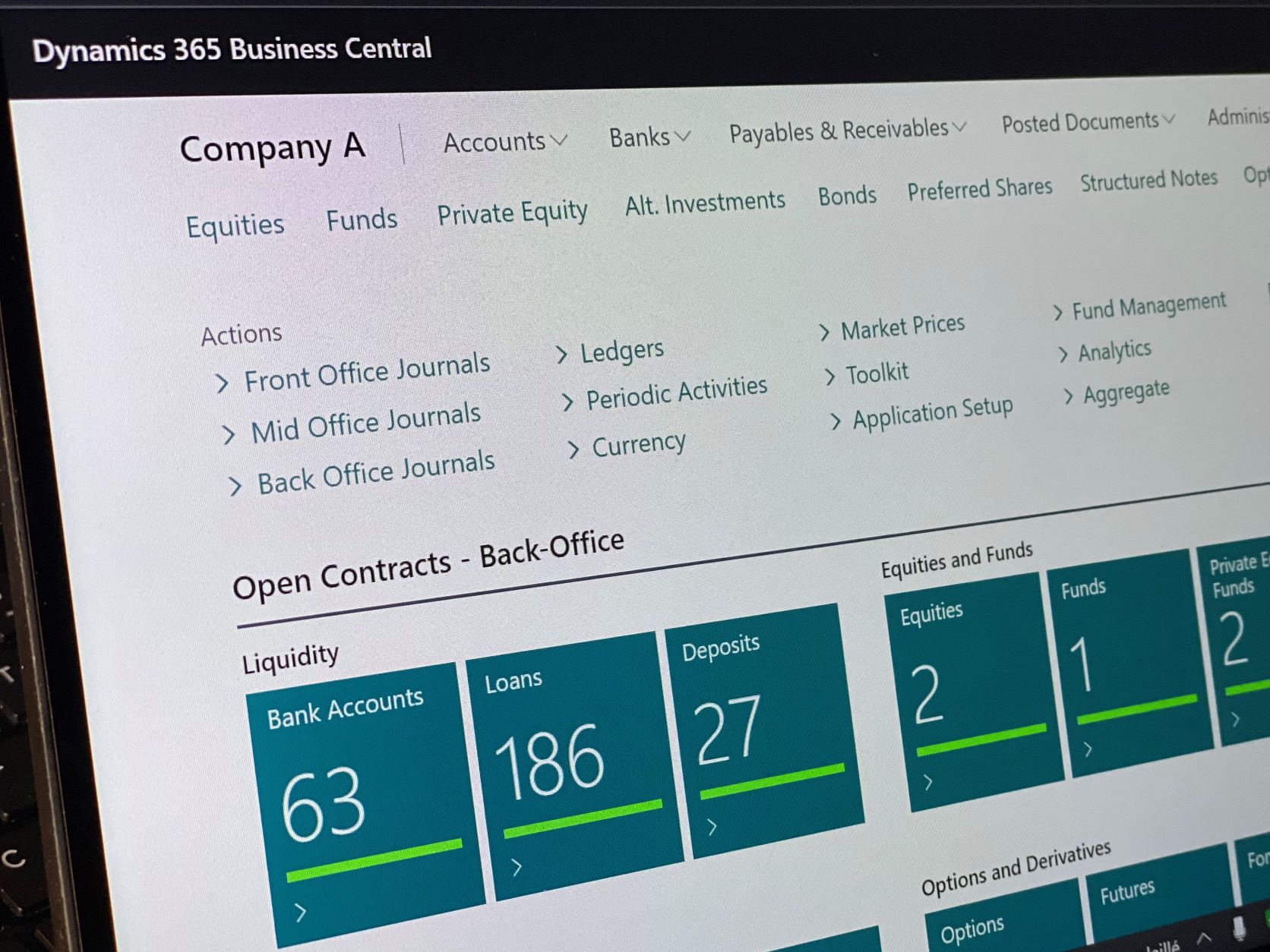

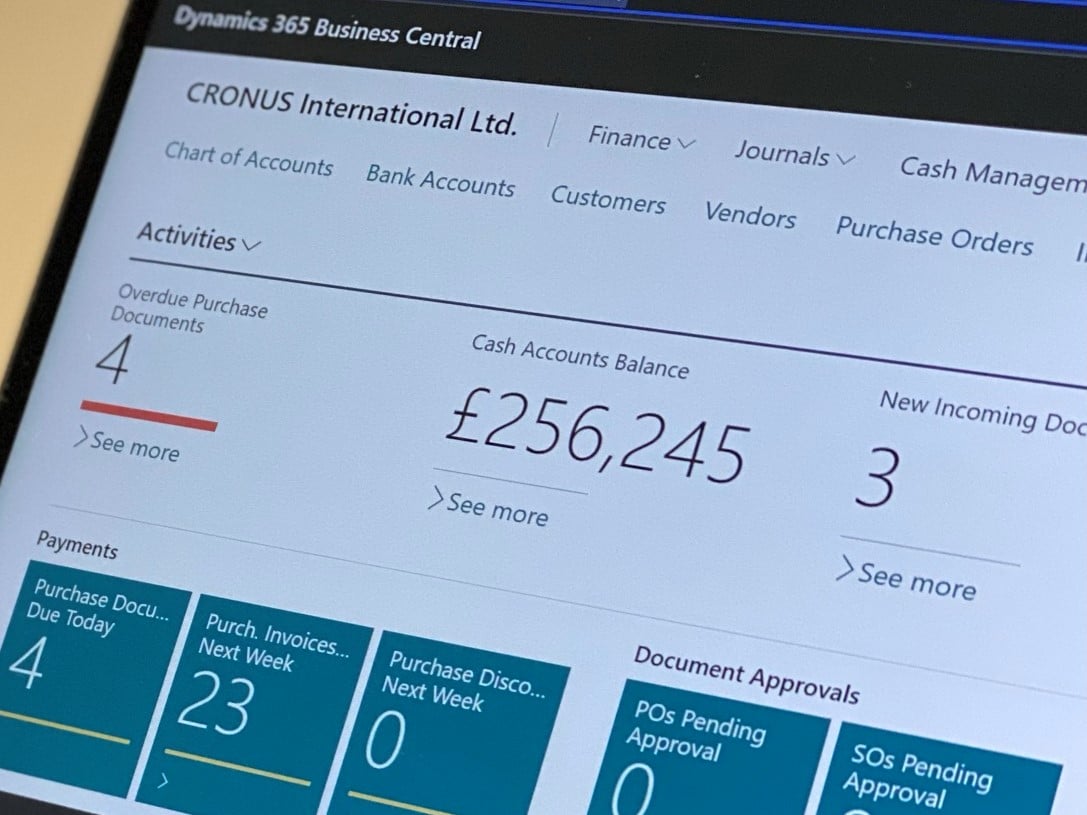

Leveraging the power and scalability of the mighty Microsoft Dynamics 365 Business Central

Why develop proprietary systems when Microsoft’s next generation of ERP comes with core best of breed financial accounting, banking, security and technology frameworks?

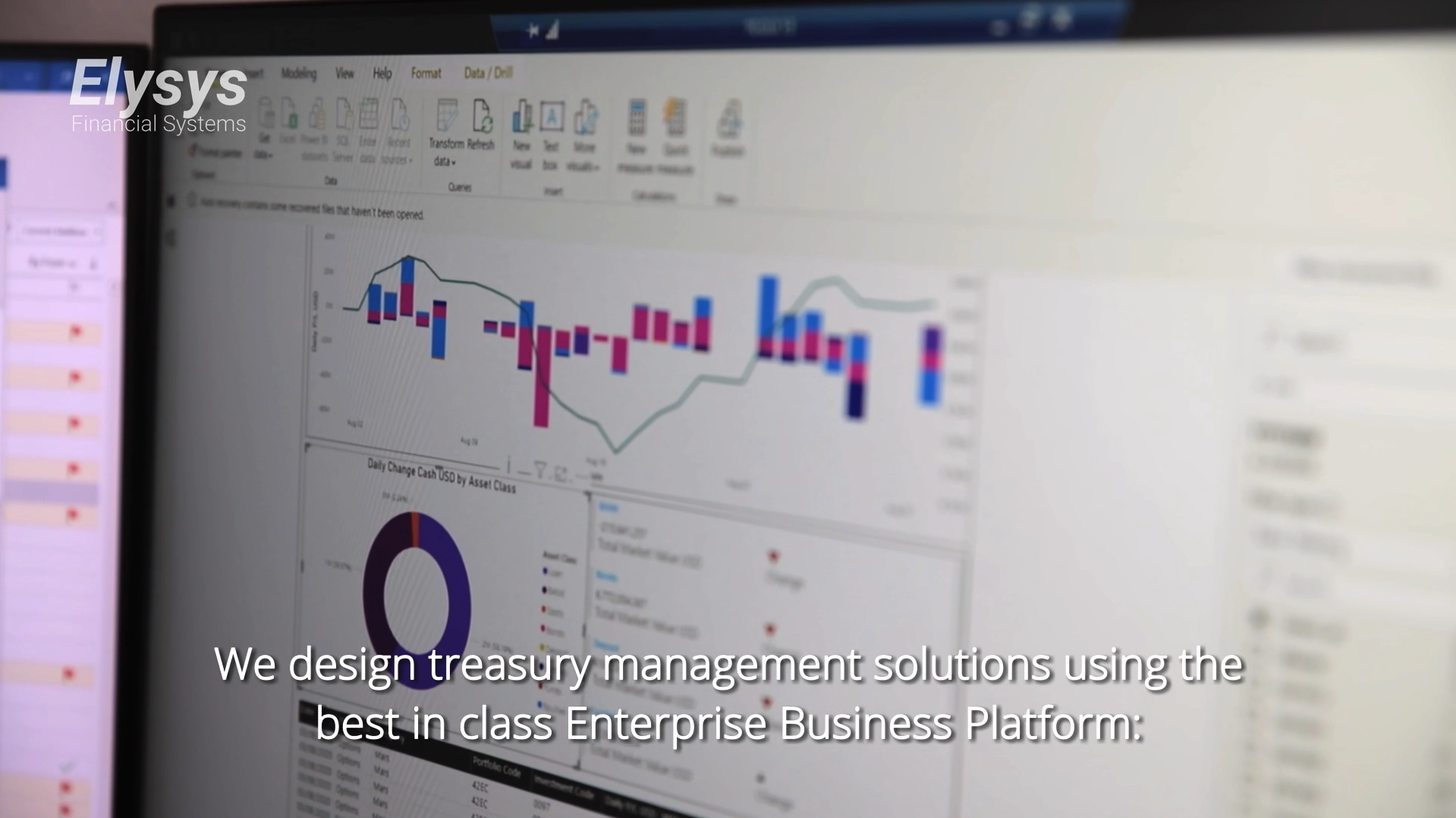

Elysys leverages the power and scalability of the mighty Microsoft Dynamics 365 Business Central platform. We bring sustainable advantage, particularly for the delivery of highly specialized treasury management applications.

Start solving your problems

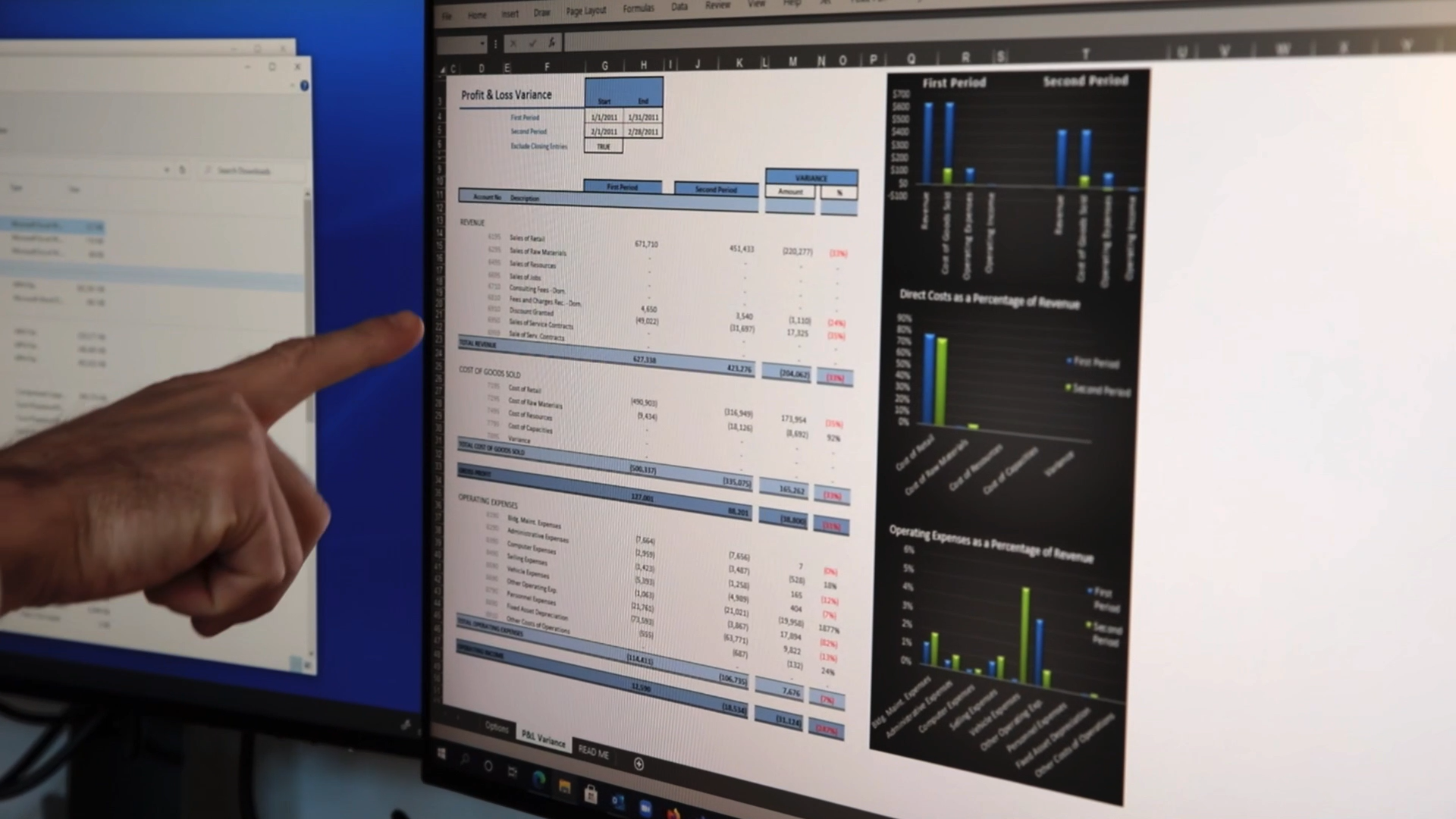

Get rid of Excel spreadsheets

Keep beneficial owners up to date

Safeguard your investments in regulatory compliance as well as equipping for future compliance challenges

Features

Straight through processing from front to back

Enterprise applications provide a uniform user experience across all departments with a single sign-on. The Single Source Of Truth (SSOT) model eliminates the silos between accounting and investment management, better enabling you to make data-driven decisions.

Aggregate, visualize...

slice and dice...

without limits

Effortlessly create bespoke dashboards and reports for any investment or financial data. Drill down to detailed transactions when necessary.

Aggregate all financial and non-financial assets across the entire portfolio and asset types. Produce financial consolidation for groups at multiple levels.

From the simplest to the most complex financial instruments, we've got you covered

For the last 15 years we have been introducing a broad range of modules spanning paper investments, money markets, derivatives, structured products, but also private equity funds and alternative investments (including Private and Public Equities, Funds, Bonds, Alts, Options, Futures, Forwards, Swaps, etc).

We provide advanced cash management features for cash flow forecasting, loans (traditional and structured) and deposit management.

Automate workflow and processes

Create one step or multi-step workflows easily and optimise the flow of documents and data across users and departments. Setup notifications and send links to remote users on any device.

Setup audit trails and logs according to your internal compliance rules. Leverage the use of the mighty Microsoft Dynamics 365 Business Central platform for your security and control.

Easily connect to custodians and brokers worldwide

Our data-feed service is designed to transfer transaction and position statements from custodian banks and brokers directly, securely and seamlessly into Elysys.

Front-office trade processing generates orders for transmission to brokers, custodians, etc. Bring in transactions and positions directly from third parties through secure channels.

Interface directly with custodians for a higher volume of transactions, including those global players in the industry (Custodians, Banks, Fund Managers, Brokers, Market Data and Clearers).

Automatic aggregation of all assets and liabilities across the board

With a single, aggregated and structured data source, the reporting and analysis task is made easier from day one.

Reporting: Use our standard reports or customize your own. Our open technology reporting tool is fast to learn and enables you to design the report you need.

Analysis: Ratios such as Time Weighted Returns or Standard Deviations are pre-calculated and stored as ‘measures’ in our data platform, providing the most advanced insight across portfolios and financial data.

SERVICES

Bring in the Experts

Specialised financial services consultancy

- Accounting

- Wealth management

- Corporate finance

- Structured finance

- Reporting and performance measurements

IT system and infrastructure management

- Cloud and on-Prem deployment

- Management and maintenance

- Security hardening

Scope Analysis & Bespoke Development

- Legacy system audit

- Business requirements gathering

- Detailed proposal

- Bespoke software developments

Implementation services and ongoing support

- Training

- Setup

- Data migration

- Reports customization

Testimonial

Elysys brought the expertise we needed to achieve measurable results

CTO, US based investment and insurance group