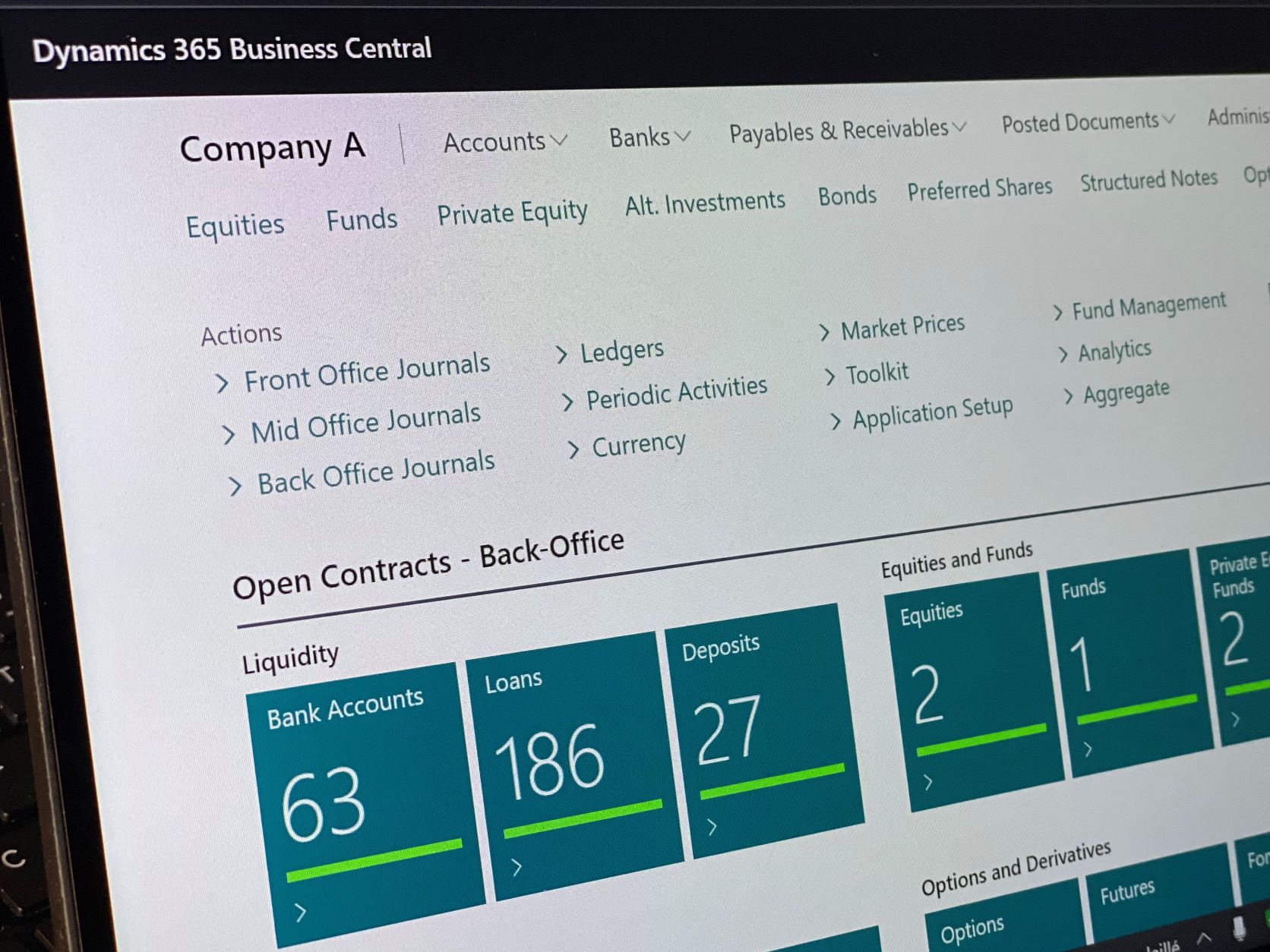

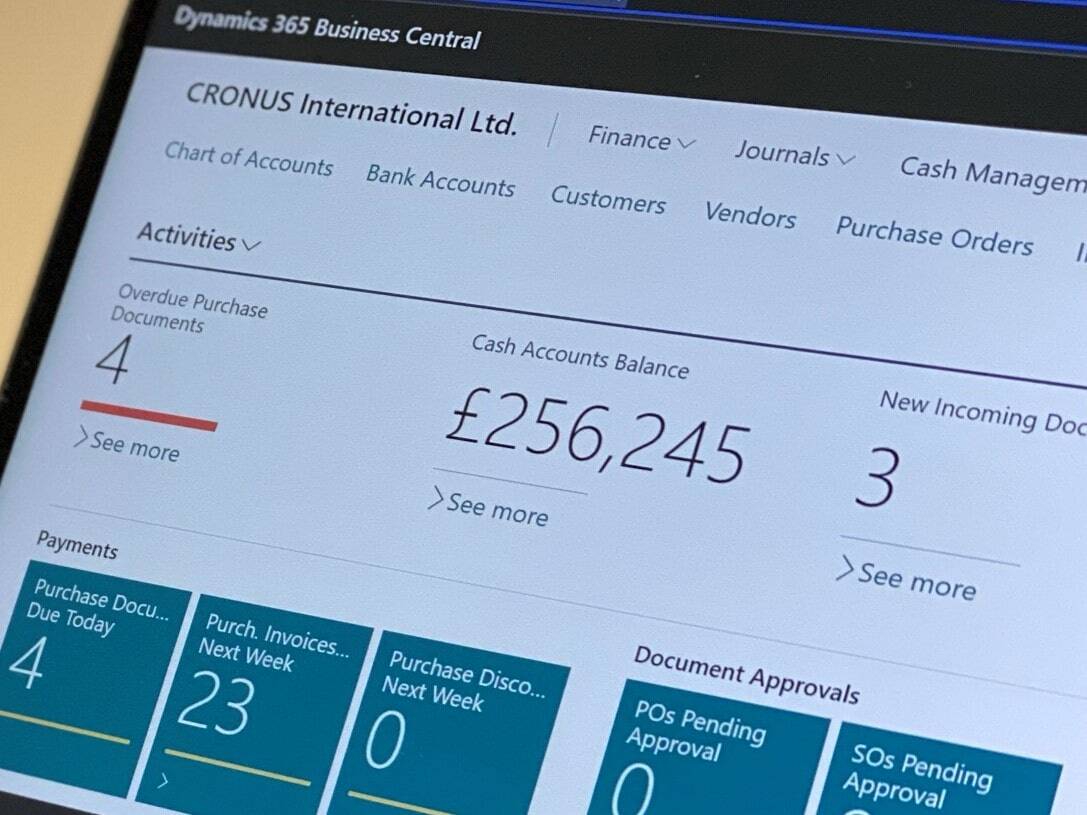

Leveraging the power and scalability of the mighty Microsoft Dynamics 365 Business Central

Why develop proprietary systems when Microsoft’s next generation of ERP comes with core best of breed financial accounting, banking, security and technology frameworks?

Elysys leverages the power and scalability of the mighty Microsoft Dynamics 365 Business Central platform. We bring sustainable advantage, particularly for the delivery of highly specialized treasury management applications.

Start solving your problems

Get rid of Excel spreadsheets

Bring your financial system to life with a solution built on the proven Microsoft Dynamics D365 Business Central used by 118,000 companies worldwide.

Safeguard your investments in regulatory compliance as well as equipping for future compliance challenges

Features

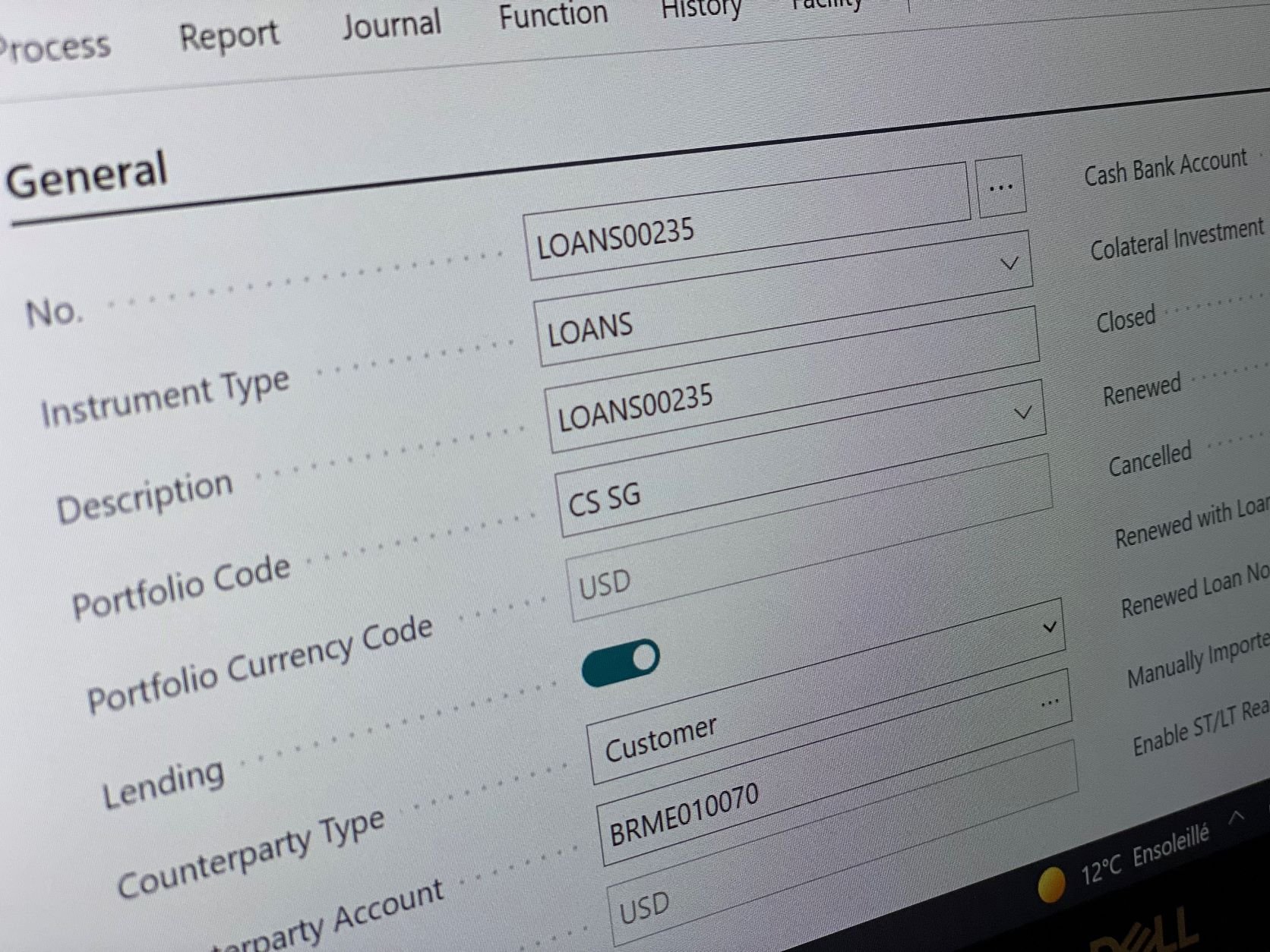

Manage all borrowing and lending in an integrated and flexible way

- Interest-only and capital repayment loans

- Fixed and variable rates

- Ad-hoc capital and interest repayments

- Currency loans and forex revaluation

- Flexible fees and commissions

- Loans to banks and customers

- Loan restructuring

- Tranches and bundle loans

- Import of manual payment schedule

Complete back-office operations

Loan transactions are processed straight through to the back office across all accounting ledgers and sub-ledgers.

Capital and interest movements, accrued interest entries, forex revaluation gains and losses, long/short term loans are all accounted automatically as per IFRS or GAAP requirements and according to pre-defined flexible accounting rules.

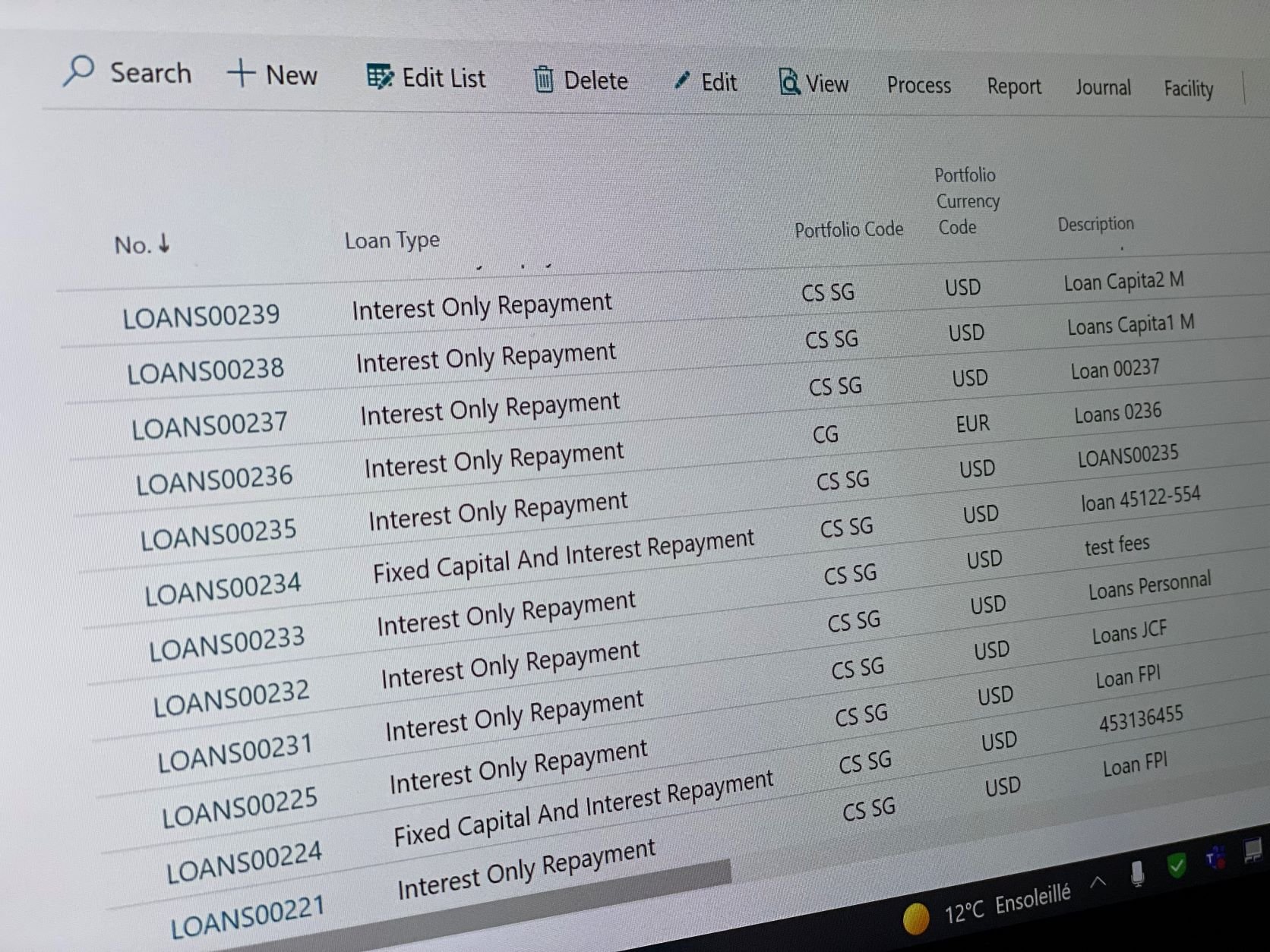

Loan views, reports and dashboards

Easily produce ad-hoc and automated reports such as loan simulation reports, loan schedule reports, loan statement reports, loan redemption reports, etc.

You can also customize your own views of loans, use powerful filtering and search capabilities, navigate to bank and general ledger entries and export to Excel.

Aggregate loan positions across multiple portfolios and entities.

Document workflows

Create one step or multi-step workflows easily and optimise the flow of documents and data across users and departments. Set up notifications and send links to remote users on any device.

Set up your company, connect with other systems, get ready for the first loan and easily report on financial health.

Connect your CRM and upload under-writing documents to initiate approval workflows.

Manage lender risks

Know your position accurately and daily with a 'single source of truth' system.

Re-value all counterparty positions with the latest index values and currency exchange rates.

Keep track of collateral along with facilities loan-to-value and headroom reports.

Automated, built-in, cashflow forecasting across all types of cash transactions.

Servicing the requirements of:

- Structured and commercial finance providers

- Asset and project finance managers

- Public sector finance

- Wealth management

- Leveraged operations management (headroom, LTV, etc.)

- Loans insurance and re-issue

SERVICES

Bring in the Experts

Specialised financial services consultancy

- Accounting

- Wealth management

- Corporate finance

- Structured finance

- Reporting and performance measurements

IT system and infrastructure management

- Cloud and on-Prem deployment

- Management and maintenance

- Security hardening

Scope Analysis & Bespoke Development

- Legacy system audit

- Business requirements gathering

- Detailed proposal

- Bespoke software developments

Implementation services and ongoing support

- Training

- Setup

- Data migration

- Reports customization

Testimonial

The Investments and loans products have all the functionalities we requireA

CEO - Large European based family office