Will diversifying your portfolio help it grow?

We all know the financial market is harder today than it has ever been, relying on traditional investments are not providing the return they once did. To combat this, investors are increasingly looking at broadening their portfolio contents, and more specifically looking at the expansion of the alternative assets share of these portfolios.

But knowing where to start is the question.

Private loans and debt funds are becoming increasingly popular, to the point where Family Offices are even beginning to compete with institutional investors, leveraging powerful Family Office software, like that of Elysys, to manage the intricate requirements that come with loan management.

Direct Private Equity investment is another popular choice, where Family Offices are looking to exploit their expertise in creating, rejuvenating and expanding existing SMBs and start-ups, as part of their investment strategies.

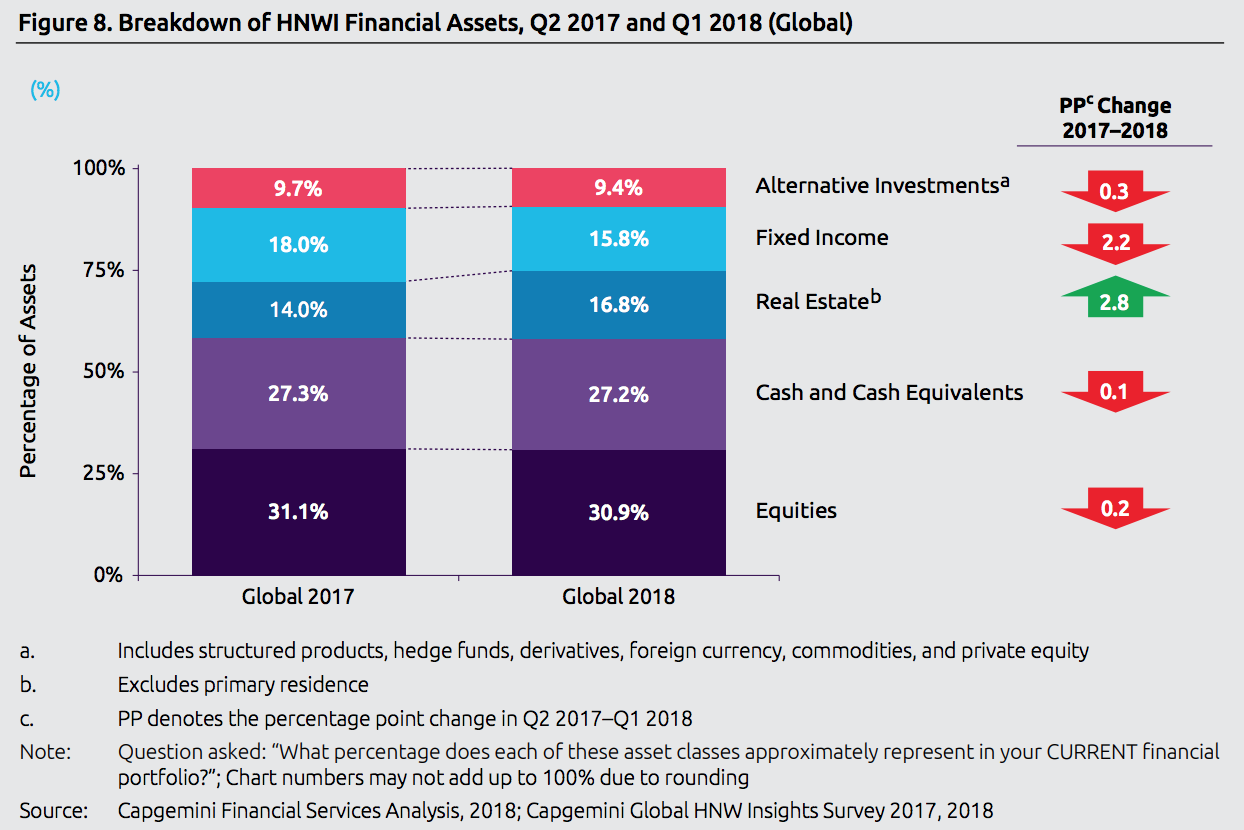

But the area with the largest growth is in Real Estate. In fact, Cap Gemini’s recent 2018 HNWI report indicates an upward trend of 2.8% in investment in real estate, rising at the expense of other assets.

What’s the challenge?

Does this diversification reflect the concerns raised due to recent political uncertainty as well as the opinion of many analysts that equities are overpriced?

Whatever the reason might be, investors need the right software to manage their operations and produce performance measurement for more complex scenarios.

Often analysts will rely on standard software to produce performance ratios, but these may not be sufficient to provide an accurate picture in these circumstances. After all, the ability to use dedicated Family Office software to select investment products, using their underlying performance, will give a Family Office the competitive advantage.

How can dedicated Family Office software give you the edge?

- To produce performance measurement reports accurately and speedily, systems need to be flexible and have direct access to data, to evaluate; performance, cash forecasting and liquidity positions.

- Family Office software needs the flexibility to adapt to investment reporting for more complex products, e.g. composites or “in-house” defined investment types.

- Software must be able to manage and account for loans and more complex financial arrangements - whether to satisfy any secondary lending activities or to leverage investment in direct private equity and real estate operations.

- Peripheral activities related to some alternative assets (e.g. property rental) need management tools that are not customarily associated with the activities of Family Offices.

- The need for Investment and entity consolidation at multiple levels increases as more and more legal or informal entity vehicles are created within the group.

- The increase in regulatory compliance will force Family Offices to exercise more control as their operations, accounting disclosure and taxation planning become more intricate.

In conclusion

Single and Multi-Family Offices are facing challenges which will only be met by the adoption of digital transformation.

Dedicated and personalised Family Office software assure family members that their portfolios can be diversified to meet the ever-increasing variety of investments available. In this way, the benefits can accrue not only to future generations but to all the philanthropic activities that result from wealth activities.

If you want to talk to us about personalised Family Office software, designed to your needs, please email us on elysys@elysys.com or call us +377 97 97 71 55.