How cloud computing is solving the tribulations of family offices

Apart from the general tribulations of the financial industry, such as economic and market volatility and increasingly stringent regulations, family offices face challenges particularly pertinent to smaller financial organisations.

The Tribulations of the Modern Family Office

Key challenges include the need for niche ERP systems, the expectations of a new generation of digitally savvy clients and budgetary constraints.

Flexible ERP Systems

Because of the unique business requirements of family offices, generalised ERP systems will always prove insufficient. Family offices resort to a combination of Excel spreadsheets and off the shelf accounting systems, or they turn towards building custom systems to meet their specific needs. This second option is expensive and requires financial and other operating staff to contribute their time and knowledge to an IT project. The ever advancing change in technology turns these solutions quickly to legacy systems, forcing family offices to allocate a permanent budget to ensure their continuous operation and update.

Client Expectations

As new family generations become involved in the operation, staff have to keep up with the demands of a generation that is computer savvy and used to having immediate access to all of their data, at the click of a button.

Budgetary Constraints

Like most business entities, family offices remain under pressure to keep operational costs low. This does not only include bank and custodian fees, brokerage and other investment trading costs, but also administrative costs (personnel representing one of the highest) and the cost of running IT systems.

How Cloud Computing Alleviates the Tribulations of Family Offices

Cloud technology in financial and wealth management software systems is serving to provide a solution to all three of the challenges mentioned above.

Historically, enterprise level wealth management software was only available to enterprise size businesses with enterprise-sized budgets. With cloud-based software, smaller single family offices have equal access to state-of-the-art ERP systems that are flexible, affordable and always available.

Improved Communications, Reduced Administrative Burden

Cloud computing makes data and applications available from any location. By operating your family office clients’ financial accounting and wealth management in the cloud, it means that your globally distributed staff, family members and advisors can access selective data and information wherever they may be situated and from any device, mobile, tablet or computer that is connected to the internet with security never compromised.

By providing your highly involved clients with secure access to their data over the internet, your staff’s communications and reporting burden is automatically reduced.

Improved Client Relationships

By utilising Cloud technology, family offices can demonstrate an active interest in management and family members who come from a digitally focused generation. While older generations often assume digital tools to be impersonal, ‘digital natives’ feel out of touch without ‘always on’ access. What is more, customisable reporting tools could provide clients with a personalised experience when they access their portfolios’ performance reporting online.

Are you concerned with allowing your multifamily office’s clients access to their portfolio and other similar data because of security or safe accessibility reasons? Cloud-hosted wealth management applications allow you to set up:

- Chinese walls between different client accounts to ensure the privacy of your clients

- unique security access protocol for different staff members and clients wishing to access the system

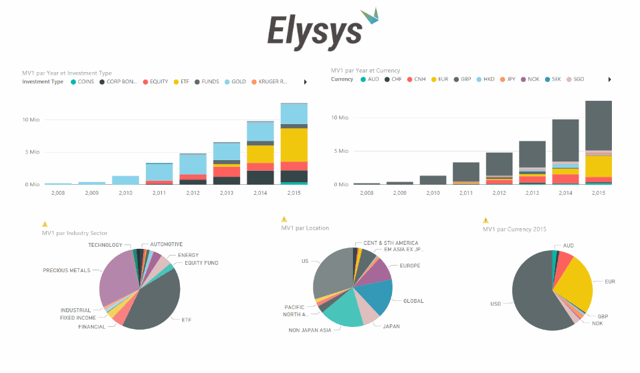

- a unique visual interface with custom reporting for each user:

Pay for What you Use

Cloud-based software lets you reduce your smaller family office’s total cost of ownership by:

- operating your ERP via shared data centres instead of implementing on-premise infrastructure

- renting software instead of buying licenses

- outsourcing IT support and maintenance

Any purchase of infrastructure or employment of staff could lead to unexpected costs. By opting for Cloud-based software, your family office gets access to enterprise level software at a (predetermined) monthly rate instead of a big upfront investment.

Onwards with Cloud-based Wealth Management and Financial Accounting

Are you ready to explore Cloud-hosted software systems for your family office? Download our free ebook now to guide you through your decision-making process.